No matter whether you're selling or buying a home, you need to know the closing costs. The costs vary from state to state, but on average they range between 6% and 10% of the sale price. These costs include the 6% broker fees, escrow fee, appraisal fees. Building flip tax, legal fees and other miscellaneous charges. Usually the seller pays these costs, but the buyer may also be asked to pay some of them.

The type of mortgage chosen will impact the amount you have to pay for seller costs. For example, you may have to pay for an upfront insurance premium of $1,750 on every $100,000 you borrow. FHA financing may require that you pay annual mortgage insurance. For multi-family properties with four or more units, you will have to pay higher rates.

Additional costs may include a property inspection, prorated property tax, termite treatment, and a property survey. Also, you should be ready to pay any homeowner's association dues.

There are other options for seller closing costs. For example, a lower owner's rate of insurance. Talk to your agent about any possible concessions. Some areas may require that the seller pay attorney fees and/or a settlement attorney. If the seller agrees, you should discuss how the payment will affect the net proceeds.

If you are looking to purchase a home in New York City, you will have to pay a NYC Transfer Tax. This fee is levied by both the New York State and the city. It is 1% on sales less than $500k; 1.425% on sales greater than $500k.

New York State Transfer Taxes will be added to the NYC Transfer Tax. They can range from 1% to 2.075% for multi-family properties, and as low as 0.1% for single family homes. Additionally, you will have to pay any recording fees levied in your municipality or county. Information on recording fees is available at the National Conference of State Legislatures.

To sell your New York City home, it is best to contact a licensed real estate agent. They will explain the process to you and help with negotiations. They will also be available to provide an estimate of the seller's closing costs.

Apart from these closing costs, you'll also need title insurance. This insurance protects your future title problems. You may need to have your property inspected by your lender. You may have to have repairs made to the property to make it more attractive. If you have low equity, it may be necessary to pay for closing costs. If you can, you should shop around for different providers.

FAQ

How do I eliminate termites and other pests?

Termites and many other pests can cause serious damage to your home. They can cause serious damage and destruction to wood structures, like furniture or decks. This can be prevented by having a professional pest controller inspect your home.

What should I consider when investing my money in real estate

First, ensure that you have enough cash to invest in real property. You will need to borrow money from a bank if you don’t have enough cash. Also, you need to make sure you don't get into debt. If you default on the loan, you won't be able to repay it.

Also, you need to be aware of how much you can invest in an investment property each month. This amount must be sufficient to cover all expenses, including mortgage payments and insurance.

You must also ensure that your investment property is secure. It would be a good idea to live somewhere else while looking for properties.

How many times do I have to refinance my loan?

It depends on whether you're refinancing with another lender, or using a broker to help you find a mortgage. In both cases, you can usually refinance every five years.

How much money do I need to purchase my home?

This varies greatly based on several factors, such as the condition of your home and the amount of time it has been on the market. Zillow.com shows that the average home sells for $203,000 in the US. This

What should I look for in a mortgage broker?

A mortgage broker assists people who aren’t eligible for traditional mortgages. They shop around for the best deal and compare rates from various lenders. There are some brokers that charge a fee to provide this service. Others provide free services.

How long does it usually take to get your mortgage approved?

It is dependent on many factors, such as your credit score and income level. Generally speaking, it takes around 30 days to get a mortgage approved.

Statistics

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

External Links

How To

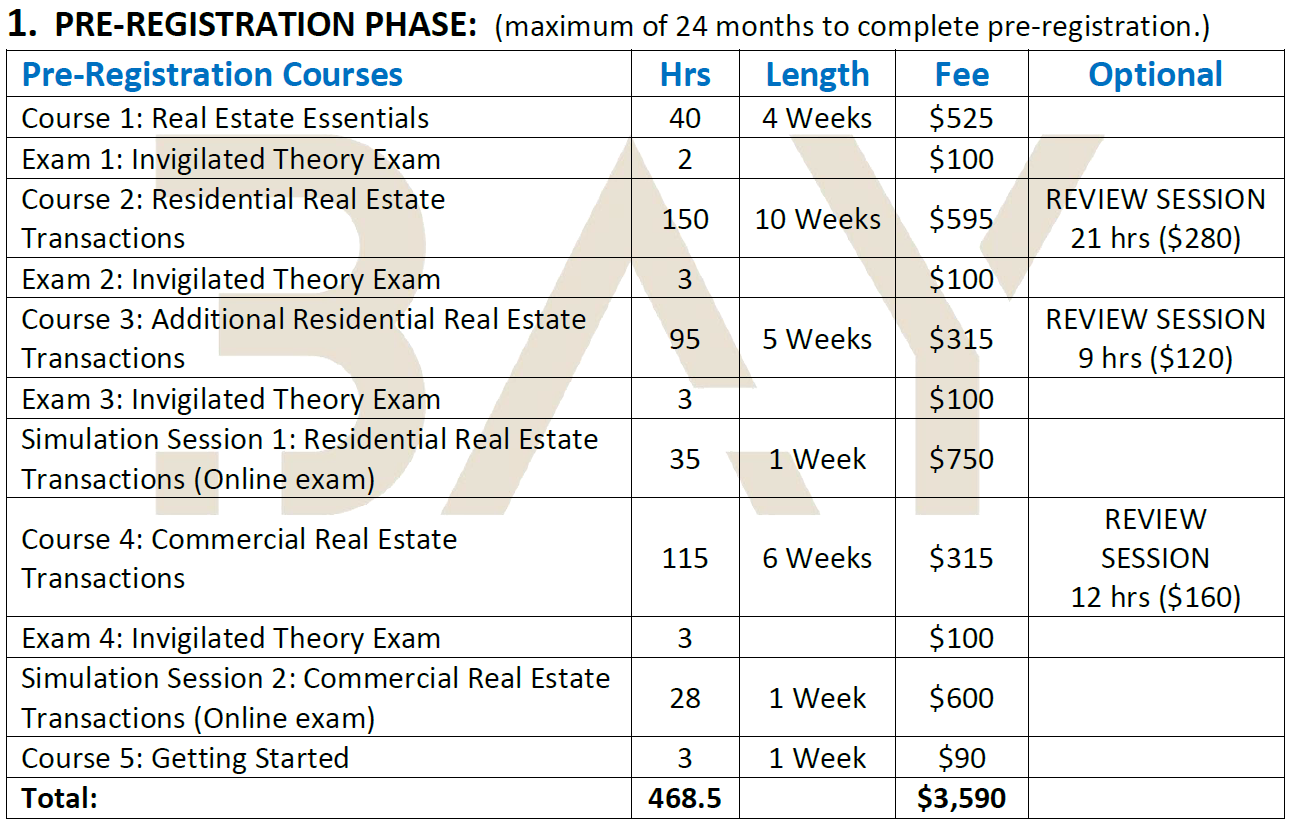

How to become a broker of real estate

An introductory course is the first step towards becoming a professional real estate agent. This will teach you everything you need to know about the industry.

Next, you will need to pass a qualifying exam which tests your knowledge about the subject. This involves studying for at least 2 hours per day over a period of 3 months.

Once you have passed the initial exam, you will be ready for the final. To be a licensed real estate agent, you must achieve a minimum score of 80%.

You are now eligible to work as a real-estate agent if you have passed all of these exams!