A home purchase is a complex process that requires extensive paperwork and disclosures. A great listing agent can be a tremendous help in this process, helping to avoid the pitfalls and simplifying it. A good agent can also provide valuable insight about the area and market to make it easier to sell your house at the highest possible price.

Listing agents can represent both buyers and sellers. This is called dual agency. Dual agency can be a cost-saving measure that requires the buyer to pay a commission. However, this can lead to buyers being turned away and the home staying on the market for a longer time.

A professional listing agent will conduct a market analysis to determine current market conditions and recommend a listing value. The right price can improve the likelihood of your house selling quickly and maximize profits. Choosing a competitive price can also help you avoid the dreaded "seller's market" and keep your home from languishing on the market.

A good listing agent can also screen potential buyers for you. They are able to tell you which homes are worth purchasing and which ones are not. They can help you close your deal faster. This is especially important if you need to sell quickly. They can also help you find a good mortgage pre-approval. They can arrange tours for potential buyers to see your house.

A great listing agent will do all of the above, as well as answer questions you have. They will be able to recommend the best marketing strategies for you to attract buyers and to sell your house at the highest price. They will also be able to give you advice about how to stage your house and what repairs to do to maximize it's potential. If required, they can coordinate open houses and arrange professional photography.

A good agent will be able to tell you about the market and the MLS. They can tell you the best way to prepare your house for sale and the ways to avoid potential pitfalls. They can also give advice on pricing your home for today's market.

A listing agent may not be necessary for you if your home is in a rural area or you have been away from the market for some time. Before you hire one, however, you should do your research. You can review the track record of agents and their reviews. Also, ask for recommendations from family and friends.

It is crucial to choose a top-rated listing agent when selling your home. A great listing agent can protect you from losing a deal and make sure you have a stress-free and smooth closing. The listing agent is your central point of contact during the entire process. They are your key to a successful home-selling journey.

A good agent will also be able to give you advice about how to price your house and what to expect from the negotiation process. They can offer advice on staging your house and recommend easy fixes that can increase the home's value.

FAQ

Which is better, to rent or buy?

Renting is typically cheaper than buying your home. It is important to realize that renting is generally cheaper than buying a home. You will still need to pay utilities, repairs, and maintenance. A home purchase has many advantages. For example, you have more control over how your life is run.

What flood insurance do I need?

Flood Insurance protects against damage caused by flooding. Flood insurance helps protect your belongings, and your mortgage payments. Learn more about flood coverage here.

Is it possible fast to sell your house?

You may be able to sell your house quickly if you intend to move out of the current residence in the next few weeks. But there are some important things you need to know before selling your house. You must first find a buyer to negotiate a contract. Second, prepare your property for sale. Third, you need to advertise your property. Finally, you should accept any offers made to your property.

What is a "reverse mortgage"?

A reverse mortgage is a way to borrow money from your home without having to put any equity into the property. This reverse mortgage allows you to take out funds from your home's equity and still live there. There are two types: conventional and government-insured (FHA). A conventional reverse mortgage requires that you repay the entire amount borrowed, plus an origination fee. FHA insurance will cover the repayment.

Should I rent or purchase a condo?

Renting may be a better option if you only plan to stay in your condo a few months. Renting can help you avoid monthly maintenance fees. The condo you buy gives you the right to use the unit. The space is yours to use as you please.

Statistics

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

External Links

How To

How to be a real-estate broker

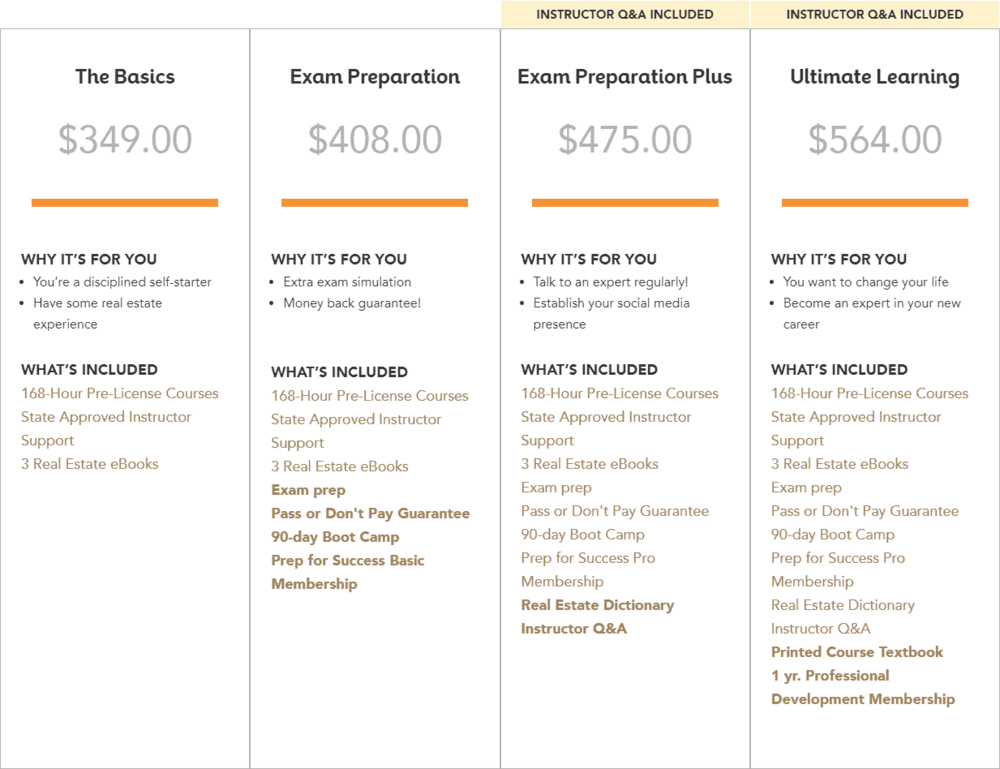

You must first take an introductory course to become a licensed real estate agent.

Next you must pass a qualifying exam to test your knowledge. This means that you will need to study at least 2 hours per week for 3 months.

You are now ready to take your final exam. In order to become a real estate agent, your score must be at least 80%.

All these exams must be passed before you can become a licensed real estate agent.