Real estate agents can be a good choice for anyone looking to enter the field full-time, or just as a potential career. You will not only be able to make a living but also have the ability to choose your own hours and become your own boss. Before you get your feet in front of the door, it is important to be clear on what steps you must take.

1. Real estate agent schooling

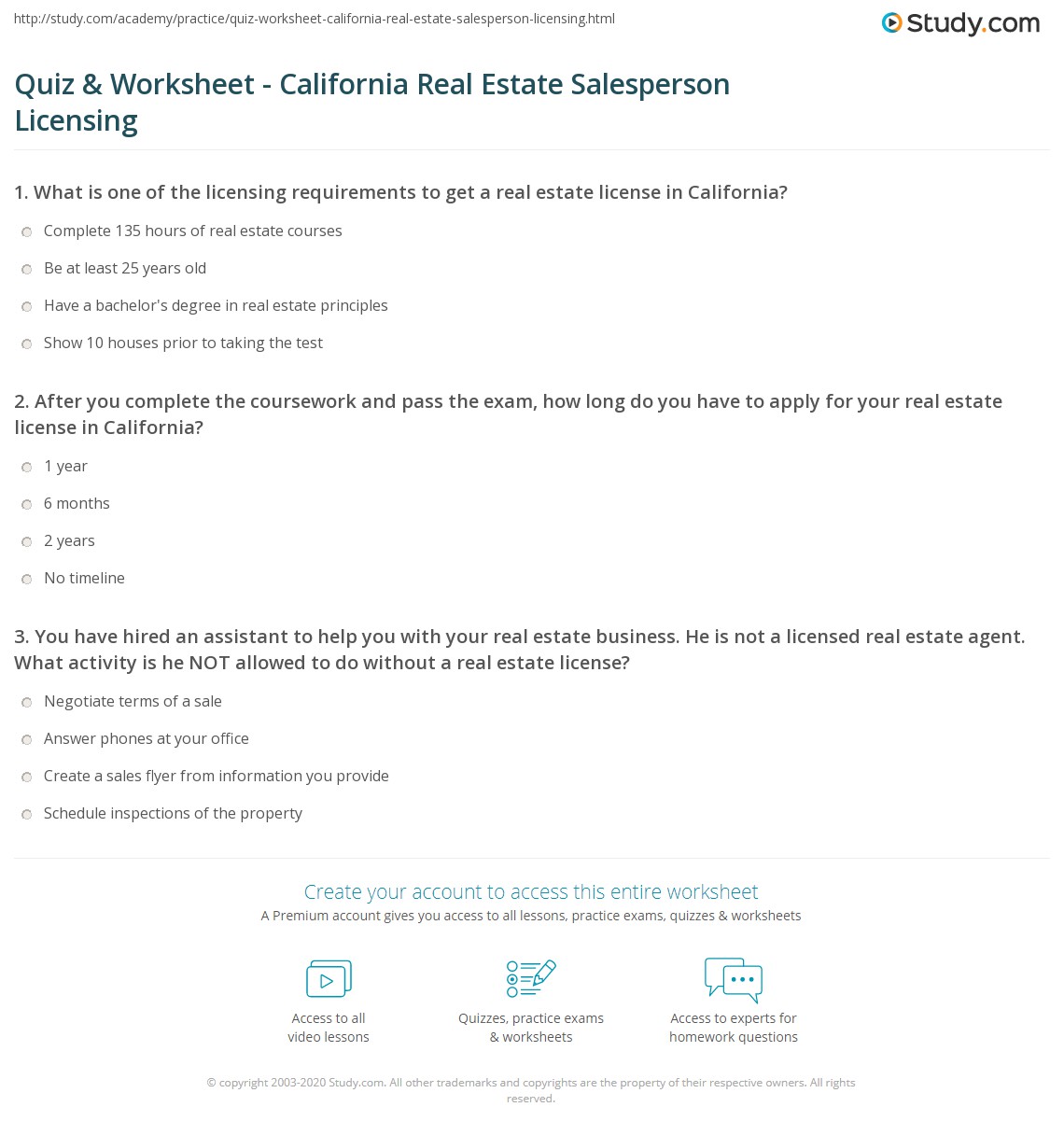

There are a number of pre-licensing courses that can help you get started in real estate. These courses cover everything related to real estate: property inspections, legal aspects, and more. To find out more about these courses and the schools that are accredited, visit your state's website for the real estate commission.

2. Real estate agent licensing

While getting your real estate licence can seem difficult, it's actually not that hard. After you have successfully completed your pre-licensing program, you can apply online or via mail for your realty license. Depending on the state, it can take anywhere from one week to two weeks for this process.

3. Locating a broker

A sponsoring broker is necessary in order to become a real estate agent. These brokers can help you market yourself and find clients. They also give you valuable experience as an agent. It's best to find a broker as soon as you pass your real estate exam. Then you can get started once you are licensed.

4. Training for real estate

Staying current with industry trends and laws is the best way to make sure you succeed as a real-estate agent. You can do this by taking additional classes, completing online courses, and attending conferences.

5. Developing your market knowledge

Expertise in your local market will make you more appealing to sellers and buyers. This can help you price your home correctly and negotiate a deal.

6. Social media presence:

Social media is an integral part of marketing yourself as real estate agent. It is important to have a fully-fleshed profile on all major platforms. You must also be active in engaging with potential clients and followers.

7. Continuing education

In order to keep up with the latest industry trends, maintaining your license is a crucial step. For their license to be renewed, most states require agents to take between 8 and 90 hours worth of continuing education classes every couple years.

8. Manage your money as an agent in real estate

Real estate, as with many other professions, is not a fast-track to riches. You'll need to have a decent amount of savings to fall back on if you lose your job or encounter unexpected expenses.

9. Having a good working relationship with your broker

It is vital that any new agent chooses the right broker to ensure their success. A good broker will provide you with the tools and resources you need to sell your listings, including a wide array of training materials and marketing options.

FAQ

How do you calculate your interest rate?

Market conditions impact the rates of interest. The average interest rate over the past week was 4.39%. Add the number of years that you plan to finance to get your interest rates. For example, if you finance $200,000 over 20 years at 5% per year, your interest rate is 0.05 x 20 1%, which equals ten basis points.

What are the cons of a fixed-rate mortgage

Fixed-rate loans tend to carry higher initial costs than adjustable-rate mortgages. You may also lose a lot if your house is sold before the term ends.

How long does it take to sell my home?

It all depends upon many factors. These include the condition of the home, whether there are any similar homes on the market, the general demand for homes in the area, and the conditions of the local housing markets. It can take from 7 days up to 90 days depending on these variables.

Statistics

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

External Links

How To

How to Manage a Rental Property

It can be a great way for you to make extra income, but there are many things to consider before you rent your house. This article will help you decide whether you want to rent your house and provide tips for managing a rental property.

Here's how to rent your home.

-

What is the first thing I should do? Take a look at your financial situation before you decide whether you want to rent your house. If you have any debts such as credit card or mortgage bills, you might not be able pay for someone to live in the home while you are away. You should also check your budget - if you don't have enough money to cover your monthly expenses (rent, utilities, insurance, etc. It may not be worth it.

-

How much does it cost for me to rent my house? There are many factors that influence the price you might charge for renting out your home. These include factors such as location, size, condition, and season. Prices vary depending on where you live so it's important that you don't expect the same rates everywhere. Rightmove estimates that the market average for renting a 1-bedroom flat in London costs around PS1,400 per monthly. This means that you could earn about PS2,800 annually if you rent your entire home. Although this is quite a high income, you can probably make a lot more if you rent out a smaller portion of your home.

-

Is this worth it? There are always risks when you do something new. However, it can bring in additional income. Be sure to fully understand what you are signing before you sign anything. Your home will be your own private sanctuary. However, renting your home means you won't have to spend as much time with your family. Make sure you've thought through these issues carefully before signing up!

-

Are there benefits? There are benefits to renting your home. There are plenty of reasons to rent out your home: you could use the money to pay off debt, invest in a holiday, save for a rainy day, or simply enjoy having a break from your everyday life. You will likely find it more enjoyable than working every day. Renting could be a full-time career if you plan properly.

-

How can I find tenants? After you have made the decision to rent your property out, you need to market it properly. Start by listing online using websites like Zoopla and Rightmove. Once you receive contact from potential tenants, it's time to set up an interview. This will help to assess their suitability for your home and confirm that they are financially stable.

-

How do I ensure I am covered? If you're worried about leaving your home empty, you'll need to ensure you're fully protected against damage, theft, or fire. You will need to insure the home through your landlord, or directly with an insurer. Your landlord may require that you add them to your additional insured. This will cover any damage to your home while you are not there. This does not apply if you are living overseas or if your landlord hasn't been registered with UK insurers. You will need to register with an International Insurer in this instance.

-

If you work outside of your home, it might seem like you don't have enough money to spend hours looking for tenants. But it's crucial that you put your best foot forward when advertising your property. It is important to create a professional website and place ads online. Also, you will need to complete an application form and provide references. Some prefer to do it all themselves. Others hire agents to help with the paperwork. Interviews will require you to be prepared for any questions.

-

What do I do when I find my tenant. If you have a lease in place, you'll need to inform your tenant of changes, such as moving dates. You can negotiate details such as the deposit and length of stay. Remember that even though you will be paid at the end of your tenancy, you still have to pay utilities.

-

How do you collect rent? When the time comes for you to collect the rent you need to make sure that your tenant has been paying their rent. If they haven't, remind them. You can deduct any outstanding payments from future rents before sending them a final bill. If you're struggling to get hold of your tenant, you can always call the police. They will not normally expel someone unless there has been a breach of contract. However, they can issue warrants if necessary.

-

What can I do to avoid problems? Although renting your home is a lucrative venture, it is also important to be safe. Install smoke alarms, carbon monoxide detectors, and security cameras. Check with your neighbors to make sure that you are allowed to leave your property open at night. Also ensure that you have sufficient insurance. You should not allow strangers to enter your home, even if they claim they are moving in next door.