A great way to grow your business and get the best deals on real estate is to become an investor-friendly agent if you are a realty agent interested in building an investment portfolio. However, you need to know exactly what an investor is looking for in order to be successful at finding deals and closing on them.

Investor-friendly agents refer to real estate broker investors as being "investor-friendly". This is because they have a solid understanding of real estate investing and are willing to work alongside investors for the long-term. They have the connections, and relationships, to help clients find great investment properties.

They're an invaluable resource for investors who are just starting out and can help save you time by helping you find the best deals in your area. They can connect you to title companies, insurance agents, lenders, and other professionals to help you make your investments profitable.

The best investor in real estate knows the market, sub-markets, and neighborhoods where there are opportunities to invest. They will inform you about who is selling the most valuable assets in your area and which deals are most likely to make money for you.

This knowledge is essential for investors who just started out. This means they need an agent who can look at the property from several angles and help them decide if it's worth their time and money.

These agents can also assist their investors in finding financing options, including FHA loans, private lenders, hard money loans, and conventional loans. They can also be of great benefit to their clients.

These experts can help investors get estimates from contractors or flooring quotes. They will be able to save a lot of effort and increase their profits.

Their local market knowledge is invaluable, and they are able quickly find investment properties as they see them first. This gives them priority access to lucrative deals that they can either pass on to their clients or purchase them for themselves.

It can be easy to get the most out your relationship with an investment partner. However, patience is key. Your investor will have a long-term goal for the properties you're buying, and they will want to know that you understand their timeline and can help them reach it.

You'll also need to be a good listener, which is crucial for a successful working relationship with your investor. This will make them feel secure in you handling their most valuable investment in real estate.

A strong working relationship with an investor can allow you to become their preferred agent and earn repeat business or even a percentage of their profits. This can result in a win-win scenario for both you and your investor. It is definitely worth the extra effort.

FAQ

What are the cons of a fixed-rate mortgage

Fixed-rate mortgages have lower initial costs than adjustable rates. A steep loss could also occur if you sell your home before the term ends due to the difference in the sale price and outstanding balance.

Do I require flood insurance?

Flood Insurance covers flooding-related damages. Flood insurance protects your possessions and your mortgage payments. Learn more about flood coverage here.

How do I get rid termites & other pests from my home?

Over time, termites and other pests can take over your home. They can cause serious destruction to wooden structures like decks and furniture. To prevent this from happening, make sure to hire a professional pest control company to inspect your home regularly.

Statistics

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

External Links

How To

How to become a real estate broker

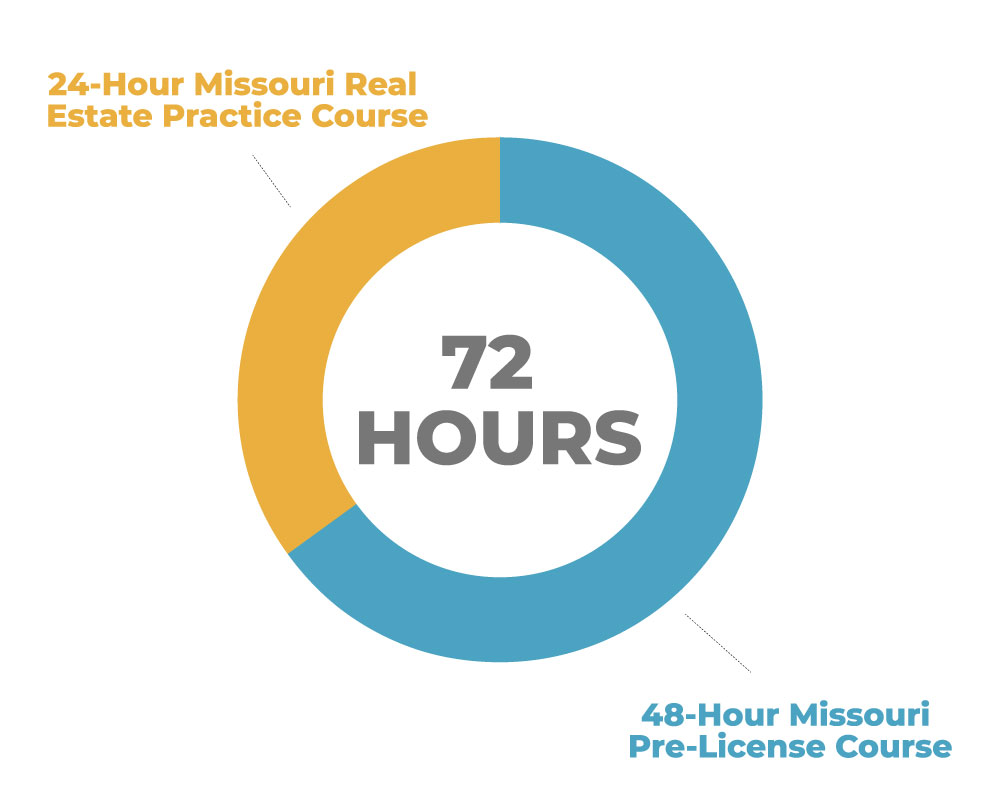

To become a real estate agent, the first step is to take an introductory class. Here you will learn everything about the industry.

The next step is to pass a qualifying examination that tests your knowledge. This requires studying for at minimum 2 hours per night over a 3 month period.

You are now ready to take your final exam. For you to be eligible as a real-estate agent, you need to score at least 80 percent.

Once you have passed these tests, you are qualified to become a real estate agent.