The career of a real-estate broker can be very rewarding. If you have the right mindset to make a career as a broker, you may be able to achieve financial independence. The career path is not for everyone. It can be hard work and challenging.

Real estate can be a very competitive field and many salespeople have difficulty reaching the top. You need to have years' of experience and meet certain criteria.

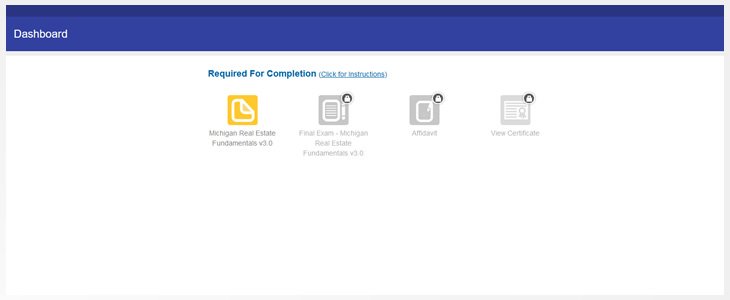

To become a licensed real estate broker you will need to have the proper license in your state. First, find a brokerage that will sponsor and train you. Then you'll need to complete the required course and pass the exam.

There are several types of brokers available. These brokers can be either individual, partnership, corporate or limited liability.

If you are a new business owner, you can get a real property broker license. This is a great way to establish your own brand and build a solid foundation for your business, but it does require some planning.

To protect your business, you will also need insurance. The most common insurances are liability, property, life and auto.

Before you commit to becoming a broker consider how much money it will cost to get started. Also, you will need to pay your licensing fees as well as any other costs associated in obtaining your real estate broker license.

It is expensive to obtain your license. Make sure you plan ahead and have enough money to cover the cost of any required courses. This is especially true for those who are looking to start their own brokerage.

As an associate broker with a brokerage, you might also collect desk fees as well as a portion of your agents' commissions. You'll have additional responsibilities, including managing your team and overseeing their transactions.

If you decide to pursue this career, keep in mind that you'll have more responsibilities than an agent and will need to be familiar with all aspects of real estate. This will require you to have a solid understanding of the industry and its workings, as well as excellent communication skills.

Also, you'll need to make sure that your staff adheres to the law and follows ethical best practices. This is a huge responsibility. You will need to invest time and effort in making sure that all your employees are trained properly and adhere to the laws.

A broker who is a good expert in all aspects of real estate should be able to help clients throughout the entire process. This will give them an edge and enable them to charge a higher commission.

It doesn’t matter if your goal is to be a real-estate agent or not. Your real estate career can be made more rewarding by having a strategic approach.

FAQ

Can I afford a downpayment to buy a house?

Yes! Yes. There are programs that will allow those with small cash reserves to purchase a home. These programs include FHA, VA loans or USDA loans as well conventional mortgages. For more information, visit our website.

Do I need flood insurance?

Flood Insurance covers flooding-related damages. Flood insurance helps protect your belongings and your mortgage payments. Find out more information on flood insurance.

What is a reverse mortgage?

Reverse mortgages allow you to borrow money without having to place any equity in your property. This reverse mortgage allows you to take out funds from your home's equity and still live there. There are two types of reverse mortgages: the government-insured FHA and the conventional. With a conventional reverse mortgage, you must repay the amount borrowed plus an origination fee. FHA insurance will cover the repayment.

Statistics

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

External Links

How To

How to Find an Apartment

When you move to a city, finding an apartment is the first thing that you should do. This process requires research and planning. It includes finding the right neighborhood, researching neighborhoods, reading reviews, and making phone calls. You have many options. Some are more difficult than others. The following steps should be considered before renting an apartment.

-

Data can be collected offline or online for research into neighborhoods. Websites such as Yelp. Zillow. Trulia.com and Realtor.com are some examples of online resources. Other sources of information include local newspapers, landlords, agents in real estate, friends, neighbors and social media.

-

Read reviews of the area you want to live in. Yelp and TripAdvisor review houses. Amazon and Amazon also have detailed reviews. You may also read local newspaper articles and check out your local library.

-

To get more information on the area, call people who have lived in it. Ask them what the best and worst things about the area. Ask for their recommendations for places to live.

-

Consider the rent prices in the areas you're interested in. Renting somewhere less expensive is a good option if you expect to spend most of your money eating out. On the other hand, if you plan on spending a lot of money on entertainment, consider living in a more expensive location.

-

Find out all you need to know about the apartment complex where you want to live. For example, how big is it? What is the cost of it? Is it pet friendly What amenities does it have? Are there parking restrictions? Are there any special rules for tenants?